Speaking at an event in 2022, Nikhil Rathi, CEO of the FCA (Financial Conduct Authority), emphasised the growing importance of data in how they supervise the UK’s financial industry. He hinted at the likelihood of future requirements for organisations to evidence how they gather, store and manage their data.

Years later, the FCA’s drive to be more data-led is one shared by many regulatory bodies globally. Businesses need to master their data if they are to keep pace with requirements.But that’s not the only incentive—aside from compliance, developing robust data management practices drives value across a financial institution’s entire operations.

In this article, we’ll explore why modernising your data management is crucial for meeting industry demands, increasing operational efficiency and ensuring compliance. You’ll also learn how data management software like Kani helps your organisation streamline processes, mitigate risks and unlock valuable real-time insights.

In this article:

- Why is data management so important in financial services?

- The benefits of improving your data management using software

- Five signs you need to modernise your data management

- Why use Kani for your data management

Want to see how data management software can help improve your business? Book a demo of Kani

Why is data management so important in financial services?

Data is the backbone of the financial services industry. From regulatory reporting to daily operations, financial service decision-makers rely on accurate, timely and secure data to function effectively.

Poorly managed data can lead to severe consequences, including:

- Compliance risks: Inaccurate data can result in failed audits, leading to hefty fines and reputational damage.

- Operational inefficiency: Without clean, accurate and accessible data, day-to-day operations slow down, increasing costs across the board. Your team might be spending their time trying to put the data together and have no resources left to investigate transaction discrepancies.

- Customer dissatisfaction: To maintain customer trust, financial institutions must ensure smooth transactions and accurate reporting. Poor data management risks delays, errors or missed opportunities.

- Decision-making challenges: Leaders depend on real-time, accurate data to make informed strategic decisions. Without it, financial institutions risk falling behind in an increasingly data-driven financial landscape.

What is data management in financial services?

To improve data management, it’s important to understand what the term really means.

Data management in the financial sector refers to any back-office process in which businesses collect, organise, cleanse and analyse data to support their commercial, operational, financial and regulatory functions. They include:

- Data collection: Gathering data from sources such as payment transactions, customer interactions and financial activities.

- Data cleansing: Removing duplicates, errors or inconsistencies to ensure your data is accurate and reliable.

- Reconciliation: Ensuring consistency between data sets by matching and identifying discrepancies across records.

- Data integration: Combining data from multiple sources (e.g., financial systems, payment processors and customer data platforms) for better analysis and reporting.

- Data storage: Archiving and organising data so it’s accessible for audits, regulatory compliance and operational needs.

- Data analysis: Extracting insights from data to inform decisions, identify trends and improve risk management.

- Reporting: Creating reports to communicate performance metrics (such as profitability), as well as compliance data to stakeholders and regulators.

Without accurate, accessible data, financial institutions risk compliance failures, operational slowdowns and reputational damage.

Does your data management need a digital transformation but you don’t know where to start? Try a demo of Kani

The benefits of improving your data management using software

Fortunately, improving your data management processes is straightforward. By using a high-quality software platform, you can automate and simplify virtually every aspect of data management.

Here are a few key areas where software can help you master data management:

Handle massive transaction volumes quickly and accurately

Financial services process huge amounts of data every day, so data quality and accuracy is critical. Even small errors create ripple effects that disrupt reporting, compliance and decision-making. If you’re handling data manually, it can be difficult to notice an error until it’s too late.

Data management software helps by automating data validation, cleansing and standardisation, ensuring that transaction records are accurate from the start.

Strengthen data security and privacy with a compliant platform

If you handle sensitive financial information, it’s important that you manage your data securely. This can be difficult manually and might be limited to a password on an Excel sheet, which can be easily lost or manipulated.

Using cloud-based data management solutions means your data is protected and encrypted. Your data can’t be lost, and it’s far easier to manage than juggling multiple spreadsheets. A quality platform will ensure compliance with relevant regulations (such as PSD2 for payment compliance) and offer security features like user groups and a comprehensive audit trail.

Mitigate risk and prevent fraud with real-time data insights

Managing risks—from credit and market risk to fraud detection and compliance—requires real-time insights into your data. Payment companies, in particular, need to monitor transaction trends and detect anomalies early. But if you’re managing your data manually, you might not notice an error in your transaction reporting until you’re audited.

Modern data management platforms offer the analytics and real-time alerts needed to stay ahead of potential risks and take corrective action before problems escalate. Having all of your data in one place where you can generate reports also makes it far easier to detect and prevent fraud.

Make faster and more informed decisions to grow your business

Access to real-time data analytics is key to making strategic decisions. However, when your data is managed manually, it’s hard to be agile. All of your data is stored in multiple spreadsheets, and it’s challenging to get a wide view of your business performance.

By the time you piece reports together, you might have already missed an opportunity. However, when your data is all on one platform, you can generate insightful reports in seconds, so you can make the best possible business decision.

Five signs you need to modernise your data management

So, you know that good data management is important, but how do you know when it’s time to upgrade to a software solution?

Here are five signs that your payment company’s data management strategy is falling behind:

1. Manual processes slow you down

Relying on manual processes to manage data is time-consuming and inefficient, particularly for payment companies that handle high transaction volumes daily. If your team spends countless hours consolidating data from multiple sources, standardising formats and manually entering information into reports, automation could be a game-changer. By automating these tasks, you could save hundreds of hours per year and significantly reduce the risk of human error, allowing your team to focus on more strategic work.

2. You struggle to keep up with regulatory compliance and are worried about fines

If preparing regulatory reports (including FCA safeguarding) feels like a scramble, it’s a clear sign that your current systems aren’t equipped to handle regulatory demands.

Your safeguarding might be costing you hundreds of hours per year, and your team don’t have the resources to investigate discrepancies. You may have heard of other businesses getting hit with fines after an audit, and you want to avoid the financial and reputational hit that comes with a failed audit.

3. Data silos limit your view of the business

When data is scattered across departments or systems, you lack a full picture of your operations: there’s no single source of truth.

Financial services dealing with data from multiple processors or channels often face this problem. A modern cloud-based data management system integrates these silos, giving you a unified business view.

4. Data inconsistencies and errors hinder decision-making

If you and your team are consistently finding inaccurate data, it’s time to make a change. If you can’t trust your data, it’s impossible to make an educated business decision.

For example, how can you confidently forecast sales, allocate budgets or assess the success of a new initiative if your reports contain conflicting numbers? Decisions based on faulty data can lead to overspending, missed growth opportunities and a failure to adapt to market changes, putting your business at risk.

Why use Kani for your data management?

Kani was created out of a need for greater efficiency. Our CEO, Aaron, saw that his team was spending too much time and effort on manual reconciliation, leading to delays and errors. He knew there had to be a better solution—one that would not only save time but also deliver more accurate, up-to-date reporting.

That’s why Kani was developed—to help payment businesses take control of their financial data, automate reconciliation and simplify reporting. Here’s how Kani supports a robust safeguarding framework and makes the audit process effortless:

Here’s what you get with Kani:

Streamline reporting with pre-built templates and real-time error detection

One of the biggest challenges financial services face is the time-consuming and error-prone process of generating card scheme reports like the Mastercard QMR or Visa GOC. This becomes even more difficult when data comes from multiple processors, often in inconsistent formats. Kani solves this by automatically ingesting, standardising, and cleansing all of your financial data.With our pre-made templates, you can generate compliant reports in a matter of seconds.

Kani helps you fulfil your reporting obligations in alignment with regulatory technical standards, saving you up to 150 hours a year that would otherwise be spent on manual data entry and formatting.

In addition to simplifying the reporting process, Kani’s real-time alerts ensure you’re quickly notified of any errors or anomalies. You can customise these alerts to notify your team via email or Slack and even share the alerts with those who aren’t directly using Kani, such as your senior leadership team.

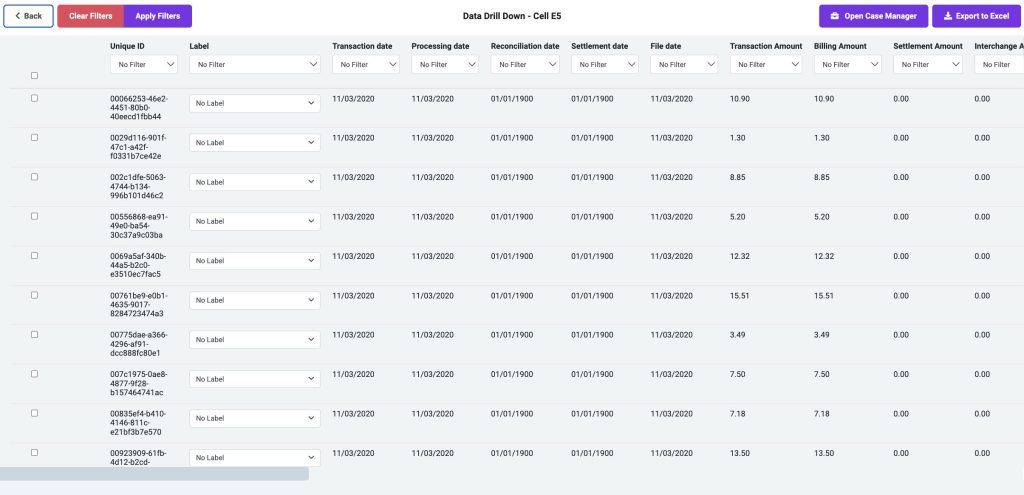

Rather than just identifying anomalies, Kani empowers you to investigate them thoroughly. For example, by setting up specific transaction monitoring rules, you can catch suspicious activities early and address any discrepancies with minimal disruption to your operations.

Ensure audit readiness with automated reports and detailed audit trails

Preparing for an audit can be a stressful process, especially when relying on manual reporting methods that leave room for errors. Kani takes the worry out of audits by automating compliance reports and maintaining a comprehensive audit trail. The platform tracks any changes made to your transaction data, offering full traceability to ensure compliance with both internal and external audits.

Kani automatically flags errors as soon as they occur, allowing you to address them well before an audit is due. The platform’s proactive nature reduces the risk of non-compliance, giving you peace of mind. With user-specific permissions, you can easily grant read-only access to auditors or senior management, providing them with all the information they need without compromising sensitive data.

For internal audits, Kani’s detailed audit history makes it simple to track transaction changes and approvals, improving transparency and operational efficiency. Fraud risk is also managed by using raw data, limiting data manipulation, and ensuring any adjustments are stamped and recorded for future reference. Sign-off capabilities further streamline the audit process by allowing reports to be reviewed and approved by senior management, with alerts triggered for any subsequent changes.

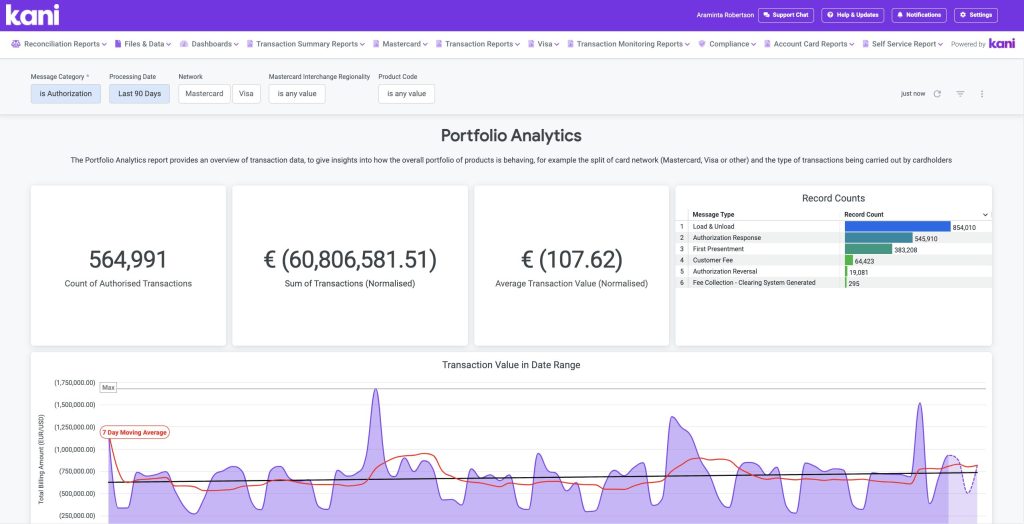

Gain deeper insights into your data with custom dashboards and visual analytics

Beyond compliance, Kani helps you turn your transaction data into actionable insights with its pre-made dashboards and visualisation tools. Instead of sifting through spreadsheets to make sense of customer behaviour or transaction trends, Kani’s visual tools make it easy to analyse data at a glance. You can quickly generate visual reports, such as pie charts comparing online and in-store transactions, to better inform business decisions.

Kani’s white-label dashboards are fully customisable, allowing you to add your branding and share insights with your team or customers. The self-serve reporting feature gives you and your team the flexibility to generate reports tailored to your specific needs without the hassle of building them from scratch. Additionally, the hierarchical drill-down capability makes it easy to investigate individual transactions, saving you from rummaging through multiple reports to find specific data points.

Kani: empowering better data management in financial services

By modernising your data management with Kani, financial services can not only meet regulatory requirements but also unlock valuable insights that drive revenue and operational efficiency. With automated reporting, real-time error detection, and intuitive dashboards, you’ll save time and reduce risks—all while gaining a clearer view of your data.

Try Kani today: book a demo