Platform

What is Kani?

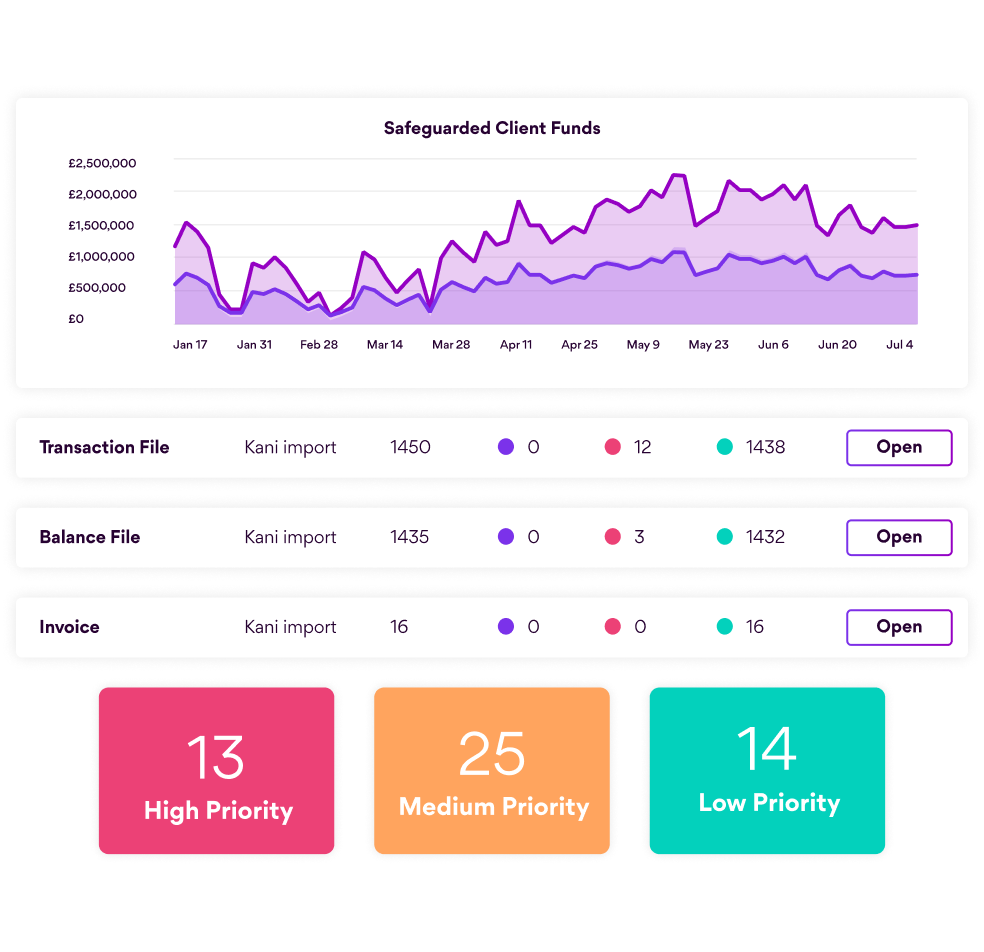

Kani is an award-winning SaaS platform providing automated reconciliation, reporting and analytics solutions to payments and banking companies

Use Kani to…

-

Reconcile

An end-to-end, high-volume reconciliation tool built for the complexities of payments data

- Transaction reconciliation

- Settlement & clearing reconciliation

- Finance reconciliation

- Compliance & regulatory reconciliation

- Card network reconciliation

- Cross-border payment reconciliation

-

Report

A flexible data reporting suite with comprehensive pre-formatted and bespoke reports

- Transaction reports

- Settlement & clearing reports

- Finance reports

- Compliance & regulatory reports

- Card network reports

- Cardholder reports

-

Analyse

Intuitive analytics and BI offering meaningful insights into your finance operations

- Customer & merchant analytics

- Operational analytics

- Finance analytics

- Risk & compliance analytics

- Predictive & advanced analytics

- Executive & strategic analytics

Core solutions

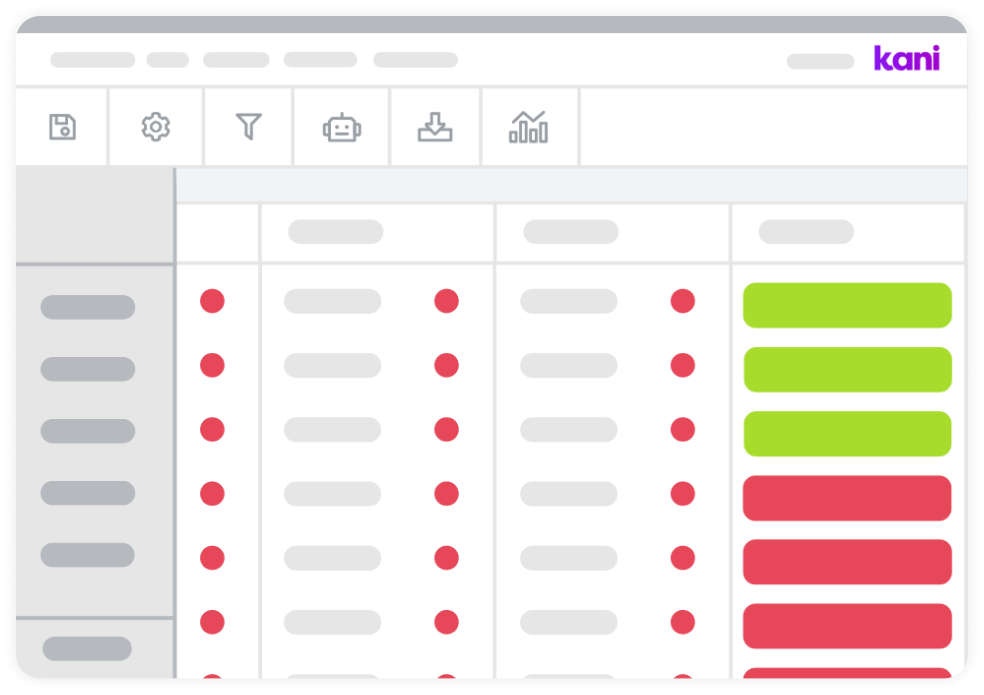

Automated reconciliation software

Lightning fast reconciliation across multiple and complex data sets

- Secure, automated data ingestion

- Adaptable to any file format or data source

- Flexible matching logic

- Automated data ingestion and validation

- Reconciliation across currencies, transaction types and payment channels

- Alerts for errors or variances

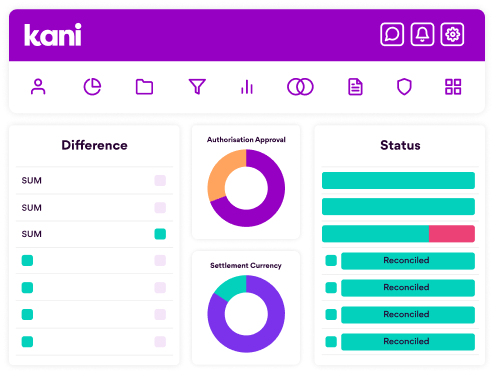

Payments reporting

Pre-formatted or bespoke regulatory, financial and card scheme reporting

- Large library of pre-built templates

- Self-service and bespoke reporting

- Metadata enrichment and data cleansing

- Ready-to-go Mastercard QMR and Visa GOC reports

- Customisable scheduling and delivery

- Automated transaction classification

Data analytics & business intelligence

Turn your data into a strategic asset with actionable insights at your fingertips

- Multi-currency forecasting and analytics

- Segment via geography, transaction type, merchant category and more

- Predictive data modelling, exploration and forecasting

- Customer and merchant risk profiling

- Analyse transaction patterns and cardholder behaviour

- Drill down and drill around functionality

Who we work with

Supporting the payments ecosystem

Issuers

Issuers help individuals and businesses make payments by managing cardholder accounts, authorising transactions and ensuring a seamless user experience

Acquirers

Acquirers facilitate smooth transactions, bridging the gap between merchants, payment networks and issuers

BIN sponsors

BIN sponsors provide the essential framework for card issuance, allowing companies to launch card programmes without a banking license

Payment processors

At the heart of the payments ecosystem, processors connect merchants, acquirers and issuers to move transactions swiftly and securely

eMoney institutions

Revolutionising how funds are stored and transferred, e-money businesses bring digital products like wallets and prepaid cards to life

Challenger banks

Challenger banks redefine how people save, spend and manage money through innovative, customer-centric banking solutions

Programme managers

Steering the success of card programmes, programme managers oversee everything from card issuance to compliance

Neobanks

Fully digital, neobanks offer convenient and accessible banking solutions without a physical presence

What makes Kani different?

Most software packages serve the entire financial sector, from asset management to insurance and everything in between. While these automated tools offer broad functionality, they often fall short of addressing the operational nuances of individual companies.

Purpose-built for payments

Kani isn’t just another finance automation tool—it’s crafted by specialists to focus exclusively on the payments and banking spaces. No wasted features. No one-size-fits all compromises. Just a laser-focused tool built by pros who’ve been in the trenches themselves.