Solutions

Mastercard QMR & Visa GOC

A one-stop automated solution to streamline your Mastercard QMR and Visa GOC card scheme reports

Key Benefits

QMR & GOC made simple

Reclaim 150+ hours annually

Achieve end-to-end automation, from data ingestion and enrichment to currency conversions and categorisation

Formatted for you

Say goodbye to manually compiling your transaction data and let Kani format reports for you

Scalability in the cloud

Our SaaS pricing tiers have no limits on transaction volumes

Eliminate submission errors

Achieve 100% compliance with reports that always meet Mastercard and Visa requirements

Expertise by your side

Our payment pros are well versed in Mastercard and Visa requirements, ready for any questions before you submit

Rapid implementation

Out-of-the-box functionality and pre-integrations with major payments processors

Preparing the Mastercard QMR (Quarterly Mastercard Report) and Visa GOC (Global Operating Certificate) should be a breeze, not a burden

Key Features

Efficiency gains

A time-saving champion

Embrace the future where QMR and GOC reports are done for you, freeing up your time for what really matters. Watch as Kani’s automated system seamlessly ingests payment processor data and delivers precise reports in seconds—all in the correct format, ready to hit send.

100% compliance

Impeccable accuracy

From automating currency calculations to data validation and enrichment checks, Kani makes sure every number is precisely where it should be. A complete audit trail allows you to access historical data or submissions.

Total control

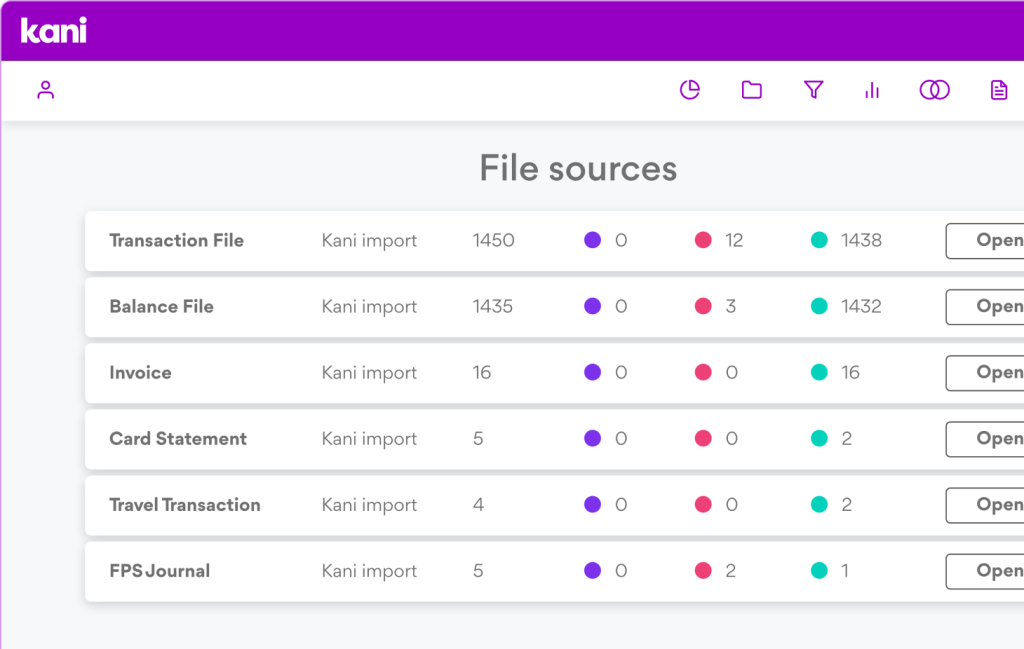

Simplify your data

Baffled by complex reporting terminology? Let us decode the jargon for you. We’ll work with your existing transaction data to ensure it’s sorted and categorised under the correct regionality, giving you accurate reports without manual interpretation.

Flexibility

Effortless integration

Our QMR and GOC solution integrates with your preferred third-party platforms, consolidating your data into a single convenient platform. We’re also pre-integrated with 30 major payment processors to get you up and running quickly.

Future-proof

Scale smarter, not harder

Scaling up? Kani’s got your back. Our robust, cloud-based platform effortlessly keeps pace with growing transaction volumes, removing back-office bottlenecks so you can grow without the grief.

QMR & GOC problems we solve

Accessing historical data

Kani offers easy access to historical reporting data. The solution archives past submissions, making them available for analysis, query and audits.

Active cards vs open cards

Our card and account management functions offer real-time visibility into active cards and open accounts for reporting.

Mapping data to standard schemas

Our solution has built-in data mapping and transformation tools, so you can easily align your data with industry-standard formats and schemas.

Validating data accuracy

We provide robust validation to ensure the accuracy of reporting data. Our platform automatically validates data against pre-defined rules, flagging inconsistencies for review.

Currency conversions

Kani’s QMR and GOC solution includes automated currency conversion capabilities. It handles conversions based on Mastercard and Visa exchange rates.

Limited transaction visibility

Users can drill down into specific datasets to validate if they have been classified under the correct regionality and other criteria.

Terminology confusions

By leveraging existing transaction data, Kani automatically classifies transactions under the correct regionality.

Powering payments & banking leaders

Platform security

Learn how we protect your information

Let’s talk

Efficiency is a demo away

See for yourself

Fill in your details and we’ll arrange a demo!

FAQs

What are Mastercard QMR and Visa GOC reports?

Card scheme reports, such as Mastercard QMR and Visa GOC reports, are comprehensive data submissions required by card networks from institutions involved in payment processing. They are essential for compliance, financial reconciliation and performance analysis in payments.

What do card scheme reports include?

Mastercard QMR and Visa GOC data reports include detailed information on transaction volumes, types and values processed over a specific period, usually each quarter. They also encompass data on cardholder activity, interchange fees, currency conversions and other transaction metrics.

Why are card scheme reports important?

Card scheme reports are crucial because they provide insights into transaction processing and fraud prevention, helping to mitigate risks associated with data security and contribute to the network integrity of the wider payments ecosystem.

What is a Mastercard T140 file?

A T140 file is a specific data format used in Mastercard QMR reports. It defines the format and structure of transaction data exchanged between financial institutions, payment processors and card networks for reporting purposes. It covers metrics like transaction amounts, merchant details and cardholder information.

What are the penalties for failed data submissions?

Penalties for failed Mastercard QMR and Visa GOC data submissions vary depending on the severity and frequency of errors. Businesses may face financial penalties, fines, sanctions or even suspension from card networks in severe cases.

Which companies need to submit Mastercard QMR or Visa GOC reports?

Card scheme reporting requirements apply to entities that process, accept, and facilitate card payment transactions. This includes financial institutions like banks and credit unions, payment processors, merchants, acquiring banks or merchant account providers, payment gateways and independent sales organisations (ISOs).

How do card scheme reports ensure timely transaction settlement?

Card scheme reports play a crucial role in the timely settlement of transactions in the payments ecosystem. Reports enable Mastercard and Visa to reconcile transactions efficiently and prevent settlement delays by providing comprehensive data on transactions, discrepancies and errors.

Are there specific formatting requirements for reports?

Yes, both Mastercard and Visa have specific formatting requirements when businesses submit their data. These typically include report structure, data fields and formatting standards like file type, encoding and layout. Each card network has predefined templates or formats for specific fields.

What are the best practices for accurate QMR and GOC submissions?

Implementing robust data management practices and leveraging automation helps to ensure accuracy and consistency in QMR and GOC data reports. Automated tools can help streamline data collection, processing and validation to reduce the risk of errors.