Solutions

Reconcile

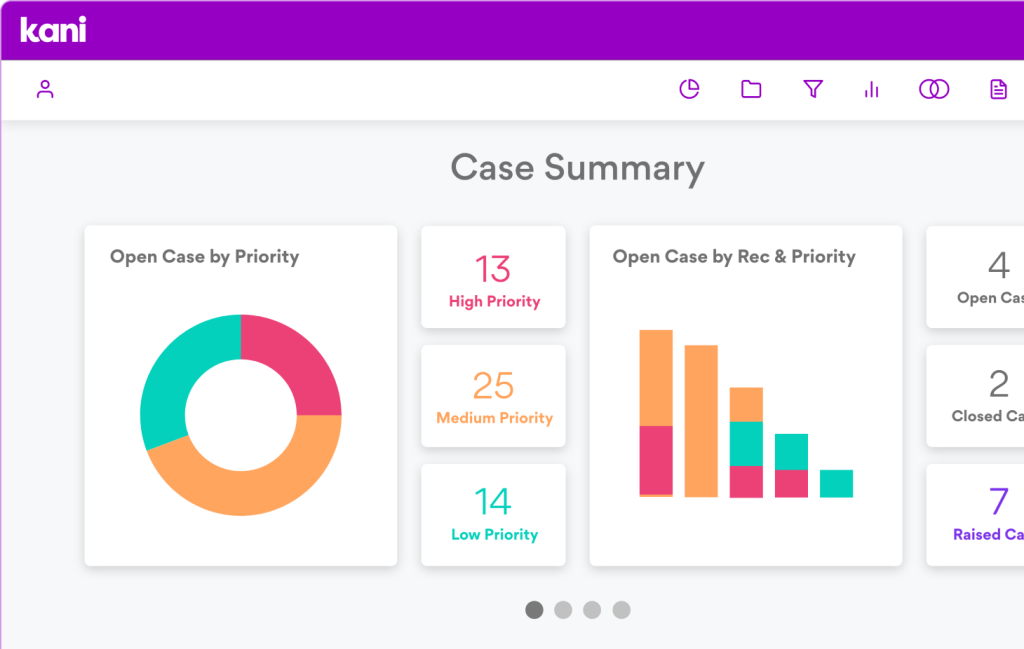

Automated reconciliation software built for the complexity of payments data

Key Benefits

Reconciliation, elevated

Grows with you

Scale your reconciliations freely without worrying about rising transaction volumes or integrating new processors

Precision you can trust

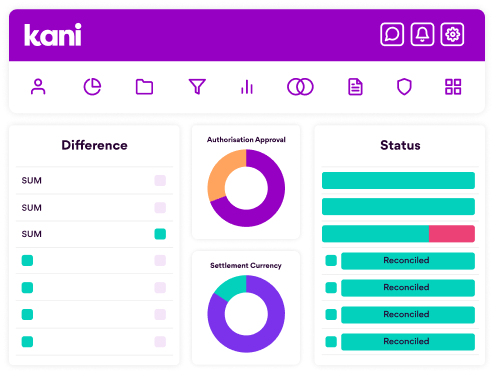

Kani’s high auto-match rates and comprehensive data enrichment and validation capabilities makes sure your numbers are always crystal clear

Save time, do more

Achieve end-to-end automated reconciliation, even across different payments channels, currencies and transaction types

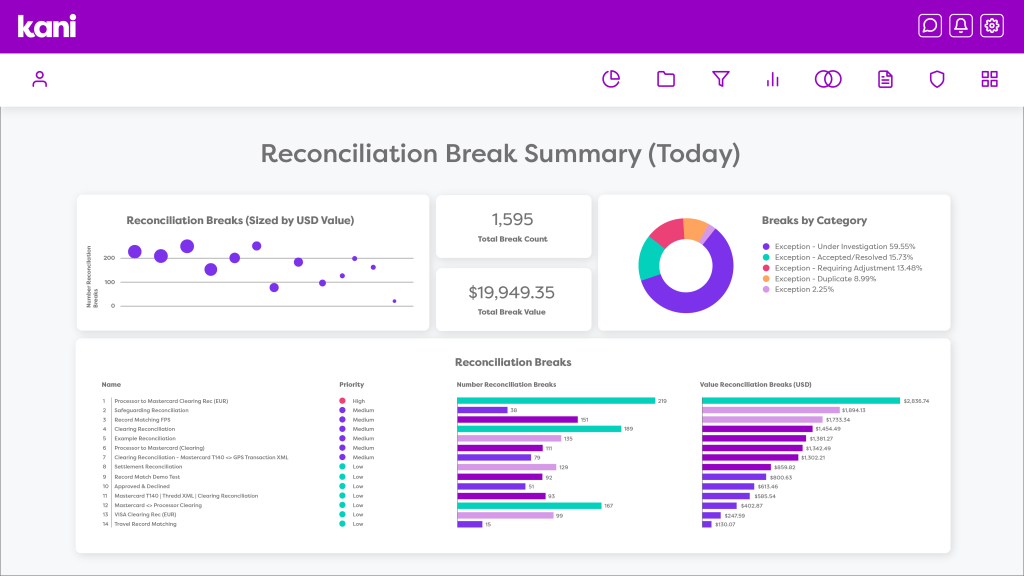

Catch issues early

Receive alerts for unmatched items, data quality issues or variances and investigate with our in-built exception management workflow

Reconcile at scale

Match large and contrasting datasets in seconds with advanced record linkage functionality

Expert support

Our friendly team are always on hand to support with investigations, root causes, fixes and platform walkthroughs

All of your reconciliation data clearly visible in one place… It’s the dream, right?

Key features

Align systems

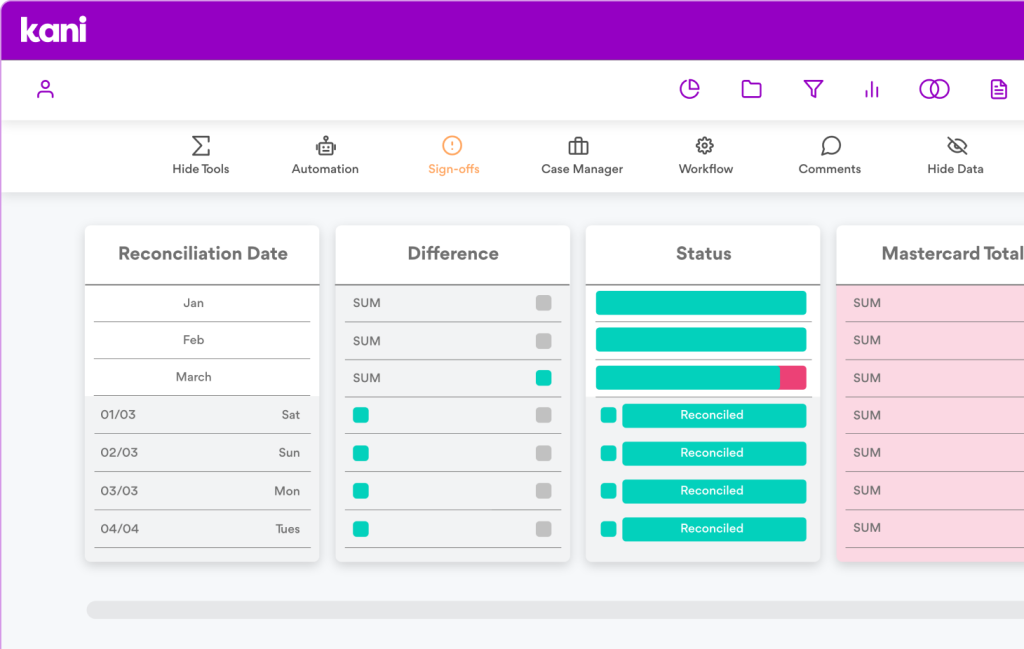

Transaction reconciliation

Accurately match transactions, balances and statements across payment systems

- Card statements to transactions

- Balance to cardholder transactions

- Transaction matching

- Account reconciliation

T+1 ready

Settlement & clearing reconciliation

Reconcile payment processor records with clearing and settlement data

- Payment processor to clearing records

- Transaction settlement reconciliation

- Issuer/acquirer reconciliation

- Cross-border settlement

Sync data sets

Finance reconciliation

Automated reconciliation between ledgers, banks and payment processors

- Bank to ledger

- Supplier statement reconciliation

- Payment processor to ledger

100% compliance

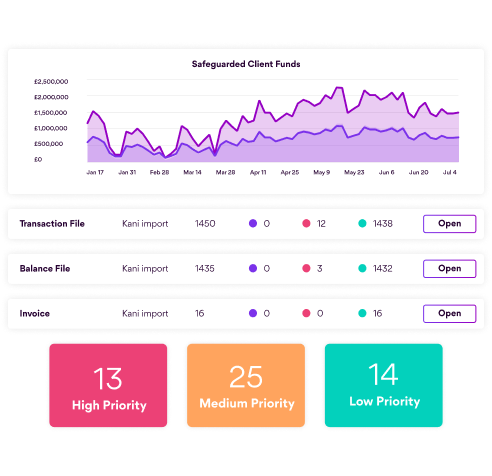

Compliance & regulatory reconciliation

Ensure compliance with regulatory reconciliation and financial control requirements

- Safeguarding reconciliation

- Daily reconciliation

- Regulatory reconciliation

Effortless matching

Card network reconciliation

Reconcile settlement, fees and transactions across card networks

- Interchange settlement reconciliation

- Disputes and chargebacks reconciliation

- Mastercard and Visa settlement

- Credit card reconciliation

Global convenience

Cross-border payment reconciliation

Seamless reconciliation and currency conversions for cross-border transactions

- Currency conversion reconciliation

- Cross-border transaction reconciliation

- Cross-border settlement reconciliation

Reconciliation source systems

Adaptable to your data

Finance

- Ledger systems (general ledger, sub-ledger, ERP)

- Banking systems (transaction records,account balances, nostro/vostro)

- Treasury management systems

- Supplier systems

Compliance & risk management

- AML platforms

- Fraud monitoring systems

- Regulatory reporting systems

- CRM systems

Transaction processing

- Payment processing systems

- Card issuing and acquiring systems

- Interchange fee systems

- Billing and fee analysis tools

- Digital wallets and alternative payments

- Dispute and chargeback management systems

Cross-border & FX

- Foreign exchange (FX) systems

- International settlement systems: SWIFT, SEPA, ACH

Powering payments & banking leaders

Platform security

Learn how we protect your information

Let’s talk

Efficiency is a demo away

See for yourself

Fill in your details and we’ll arrange a demo!

FAQs

What is automated reconciliation?

Automated reconciliation software helps to match financial data across systems without relying on manual spreadsheets. These tools automatically ingest large volumes of data and apply rules-based logic to standardise, match, compare and validate records at scale.

Why is reconciliation in payments so challenging?

Payments companies handle dynamic, high-volume data from banks, PSPs, gateways and internal systems—all with different formats and timings. Complex issues like partial payments, reversals and chargebacks need specialised handling. That’s why a specialised reconciliation solution is essential to manage payments data from end to end.

What’s the best reconciliation software for payments companies?

The right reconciliation software should adapt to your data flows—not the other way around. Look for features built for modern payment flows, like high-volume transaction matching, multi-currency reconciliation, settlement tracking and exception handling workflows.

Who uses a reconciliation tool?

Automated reconciliation tools are most commonly used by finance teams, including financial operations (FinOps), accounting and treasury departments. However, compliance, risk and data operations teams also use it to monitor data accuracy, transaction integrity and financial transparency.

Does reconciliation software help reduce reporting delays?

Yes, reconciliation software reduces reporting delays by identifying mismatches early and streamlining exception workflows. Features like case tracking and data validation allows finance teams to close books faster and report with confidence.

What are the different types of reconciliation?

Common examples include bank reconciliation, account reconciliation, transaction reconciliation and payment reconciliation. Each helps ensure data consistency across systems, supporting accurate reporting, settlement tracking and financial integrity.

What’s the benefit of automated reconciliation?

Automated reconciliation replaces spreadsheets with software built to handle high transaction volumes, ensure data accuracy and manage exceptions via dedicated workflows. It saves time, reduces errors and scales effortlessly with transaction volumes. Automation also helps improve governance and auditability, giving finance teams more control over their data.

How is reconciliation software different than ERP tools?

ERP systems manage broad business processes like accounting, procurement and inventory. While they may offer basic reconciliation features, they aren’t specialised in financial matching or complex data. Specialised software offers accurate, automated reconciliation even with multi-source financial inputs and large data volumes.